Q2 2025 Home-Based Care M&A Report

- Aug 5, 2025

- 4 min read

Updated: Aug 12, 2025

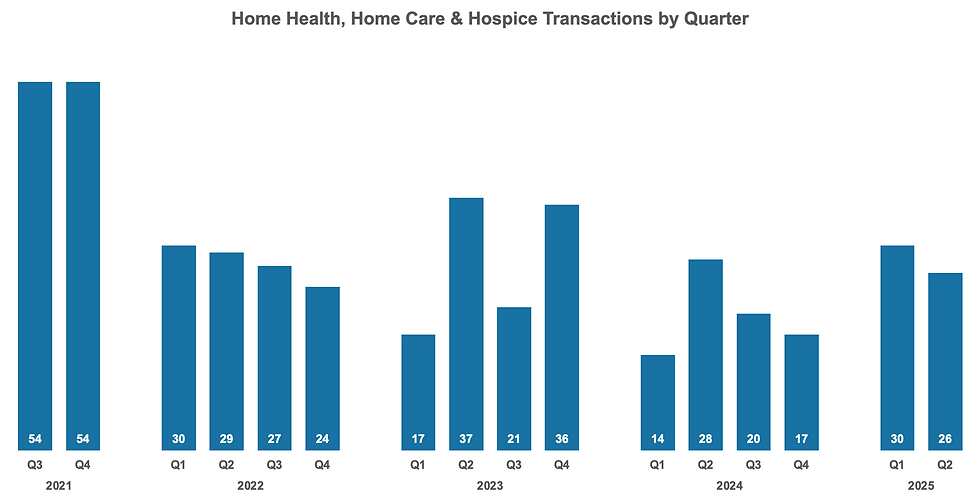

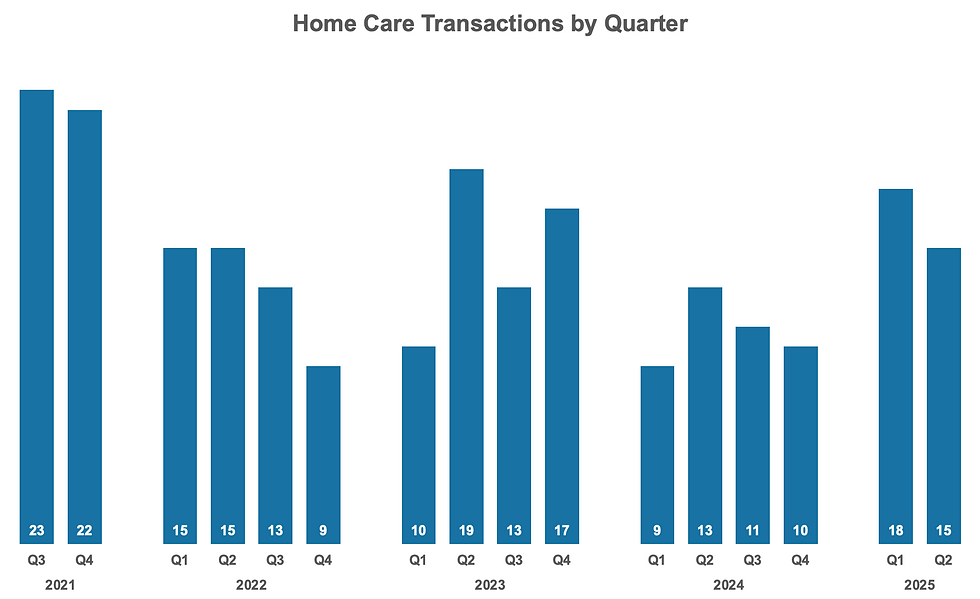

Despite macroeconomic uncertainty on many fronts, home-based care M&A activity overall remained steady in the second quarter, buoyed by non-medical home care.

A total of 26 deals involving home-based care providers were announced in the quarter. Non-medical home care accounted for 15 transactions. Of those deals, nine involved sponsor-backed portfolio companies, many of which are Medicaid and Veterans Affairs providers across multiple states.

Home-Based Care M&A

“Non-medical home care M&A is having its time,” Mertz Taggart managing partner Cory Mertz said. “We have more clarity around the OBBBA, and its impact on non-medical home-based care will be less than many feared. The DOL’s proposed return of the companionship exemption, and multiple portfolio companies gearing up for an exit in the next several months will also serve as catalysts.”

In contrast, home health and hospice have both seen slower activity, but for different reasons.

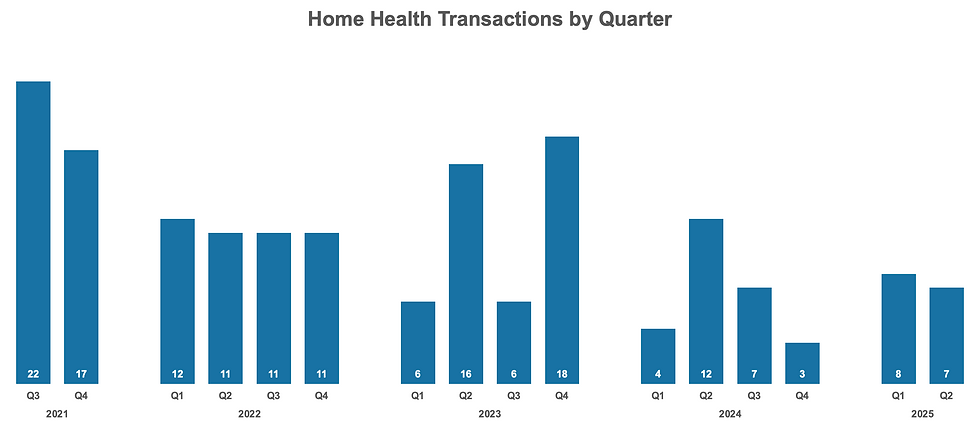

Home Health M&A

A total of seven skilled home health transactions were announced in Q2, roughly on par with the eight deals reported in the previous quarter. Among them, Aveanna announced in June that it has completed its $75 million acquisition of Thrive Skilled Pediatric Care, an independent provider of pediatric home health with 23 locations in seven states. Summit Partners exited the deal after a hold period of more than nine years.

Four home health provider deals were of the sponsor-backed strategic variety.

BPEA-backed LiveWell Partners closed on its acquisition of Empower Home Health Services. Based in St. Louis, LiveWell is a home health and hospice provider currently operating in Illinois, Kansas, Michigan, Missouri and Ohio. Founded in 2005, Empower is a privately owned home health company that operates in nine counties in the Chicagoland area.

DispatchHealth announced the close of its merger with Medically Home. The combined company will operate under the DispatchHealth brand.

The recently proposed rule from the Centers for Medicare and Medicaid Services, which includes a rate cut of 6.4% and would take effect in January 2026, will have an impact on M&A over the next few months. Mertz characterized the proposed cut as “very disappointing, but not a huge surprise."

Uncertainty over the final rule, which will be published in November, and which recent history suggests won't be as onerous as the proposed rule, will likely impact some of the transactions currently in the works.

In summary, “The transaction volume we are seeing in home health doesn’t match demand,” said Mertz. “Buyers are eager to deploy cash into quality, skilled home health assets, but are mandated to do it in a more strategic, disciplined manner than in years past. Quality assets that have gone to market recently have enjoyed strong valuations. We expect this to continue."

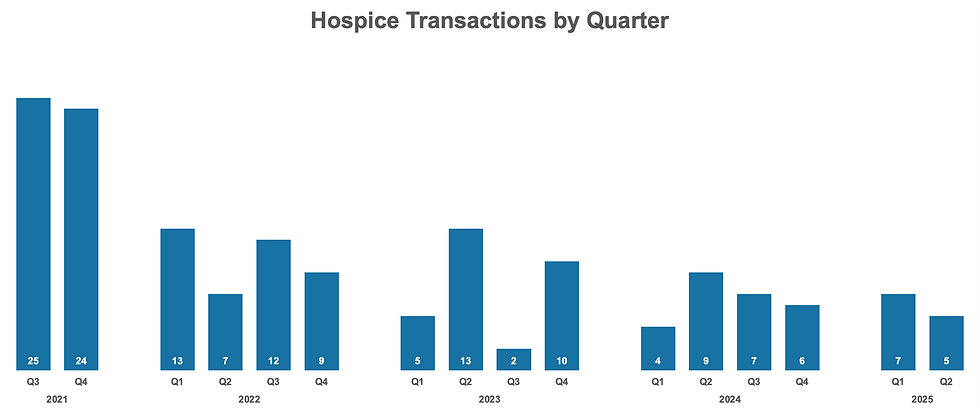

Hospice M&A

A total of five hospice transactions were announced in the second quarter, a slight dip from the seven deals reported in Q1.

Chapters Health System, a not-for-profit chronic illness care organization, finalized its affiliation with Nathan Adelson Hospice, based in Las Vegas, a move the organization said marks its first official step in the growth of its Chapters Health West division, which also includes agencies in California and Oregon.

Cressey & Company announced a partnership with Paradigm Health. Paradigm management, along with the company’s existing investor, Havencrest Capital Management, also made investments as the company pursues its next phase of growth.

Despite strong demand, deals have proven difficult to get to the closing table. Diligence around billing and compliance have caused many proposed deals to fall apart.

Buyers are fearful of Medicare clawback risk, a concern that is amplified in four “enhanced oversight” states—California, Arizona, Nevada, and Texas. As such, Mertz Taggart continues to strongly recommend that providers considering a transaction in the next 24 to 36 months first invest in a billing and compliance audit.

“We are strongly recommending a pre-market audit for operators, especially in those four states,” Mertz noted. “It’s important to use a group that will quantify the clawback risk specific to those four states, considering the current enhanced oversight environment.”

Home Care M&A

Home care saw 15 total transactions announced in Q2, including nine private equity-backed strategic deals. Active Day and Help at Home were at the forefront of this activity.

Backed by the Audax Group, Active Day acquired three more home care providers, including All Caregivers and New Generations Home Care of Florence. These acquisitions help solidify Active Day’s existing strategy of pairing its current adult day opportunities with non-medical home care. “These acquisitions are highly complementary to Active Day’s existing adult day centers in South Carolina and expands on our continuum of home and community-based services,” said Matt Donnelly, CEO of Active Day.

Vistria Group-backed Help at Home closed on three transactions in the quarter. In April, they announced the acquisitions of two Indiana-based agencies—LovAbility Home Care and BB’s Heaven on Earth Home Care Services. They followed in mid-May with a deal to acquire Home Care Now of Central Florida. Mertz Taggart has tracked 12 transactions by Help at Home over the past 12 months.

Other home care transactions for Q2 included the following:

HomeCentris Healthcare, a Spring Capital Partners portfolio company and the largest Medicaid home care provider in Maryland, completed the acquisition of First Family Home Healthcare in Philadelphia.

MedTec Healthcare, a provider of in-home care and adult day services in Illinois, was acquired by the private equity firm Waud Capital Partners through its holding company, Altocare. MedTec will join home care franchisor Senior Helpers under the Altocare umbrella.

Havencrest Capital Management announced its sixth and seventh acquisitions by its Avid Health at Home platform, boosting its presence in the Chicagoland area with a deal for Home Care Angels and in Michigan with its acquisition of Private Duty Home Healthcare.

Martis Capital-backed Amivie (formerly Community Based Care), a provider of home and community-based care services in six states, announced a partnership with Minnesota-based Cherish.

If you are interested, you can also download the .PDF version of the Q2 2025 Home-Based Care M&A Report via the following link:

Comments