Q2 2025 Behavioral Health M&A Report

- Emin Beganovic

- Aug 20

- 4 min read

Behavioral Health M&A

The 31 total behavioral health transactions were announced in the second quarter of 2025 -- the fewest reported since the onset of the COVID-19 pandemic – but a closer look at the numbers reveals a new dynamic…. a slowdown in growth deals.

“Since the pandemic, there has been a venture capital rush into early-stage mental health companies,” Mertz Taggart Managing Partner Kevin Taggart said. “We knew the sheer volume of transactions was not sustainable. I wouldn’t be surprised if this is the beginning of the slowdown for growth transactions. We saw an average of 13 growth deals per quarter over the past 3 years. In Q2, we tracked a total of five.”

Traditional M&A volume was down slightly, with 26 transactions recorded. While this is down from the 35 transactions recorded in Q1, it is in line with the post-pandemic norm.

“We are seeing a trend of fewer deal announcements,” Taggart commented. “Private equity’s push into healthcare has been under public and regulatory scrutiny over the past 12-24 months. Many of these groups would prefer to keep these transactions under the radar to the extent they are able. It’s not an attempt to avoid regulators, but rather, they don’t see the benefit in announcing.”

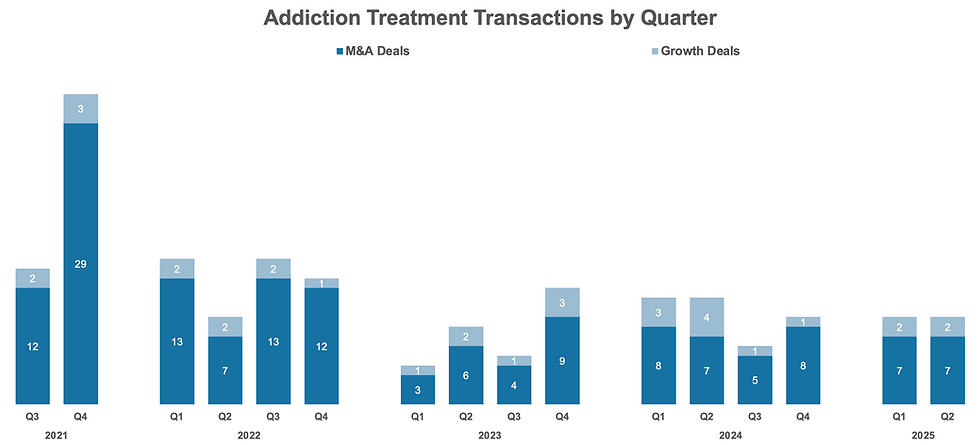

Addiction Treatment M&A

A total of nine deals—seven M&A transactions and two growth deals—were reported in the addiction treatment subcategory in Q2, matching the previous two quarters. Major players remaining in a holding pattern has kept deal volume in the addiction treatment subcategory at a slower pace, said Taggart.

“Some very notable, big-name buyers have been choosing to remain on the sidelines,” Taggart said. “But we’re starting to see a couple come back, so that’s encouraging. We’ll see how that plays out over the next couple quarters.”

Among the transactions involving addiction treatment provider organizations that were reported in the second quarter were the following private equity platform deals:

Perimeter Healthcare, a portfolio company of Ridgemont Equity Partners, was acquired by a family office.

In April, Clearview Capital Fund V and its affiliates announced the recapitalization of Laurel Springs, New Jersey-based Advantage Behavioral Health and affiliates.

Other Q2 deals in the addiction treatment subcategory included the following:

Porch Light Health in Colorado acquired Comprehensive Behavioral Health Center, an opioid treatment program (OTP) with clinics in Denver and Lakewood, Colorado. The deal allows Porch Light Health to now offer a full spectrum of medication-assisted treatment options.

T&R Recovery closed on a non-controlling investment from Genesis Park, through its investment fund, GP Capital Partners, and Cyprium Partners, through its investment fund, Cyprium SBIC.

Oar Health, a provider of alcohol addiction treatment services, received a $10 million investment from IAC Inc., a New York-based holding company.

Rosecrance Health Network announced its acquisition of North Central Behavioral Health Systems in central Illinois.

Butler Behavioral Health and Best Point Education and Behavioral Health, a pair of Ohio-based not-for-profit behavioral health organizations, announced a merger in June. Per terms of the deal, Butler will operate as a wholly owned subsidiary of Best Point. The companies will operate with a combined annual revenue of $65 million.

Mental Health M&A

Mental health continued to lead the way in terms of behavioral health transactions in Q2, accounting for 21 of the 31 deals announced overall. Eight transactions involving mental health providers were private equity-backed strategic deals.

Shreveport, Louisiana-based Seaside Healthcare sold off its two major behavioral health divisions in separate deals. In one transaction, The Graph Group acquired Seaside’s acute and intermediate behavioral health services.

In addition to the sale of its acute and intermediate behavioral health services, Seaside Healthcare’s outpatient therapy services were sold to SUN Behavioral Health.

US Pediatric Partners in North Carolina acquired Hope Services, a provider of community-based mental health and care management services with three locations in the greater Raleigh, North Carolina, area.

PAX Health, a behavioral health company backed by HCAP Partners and funds managed by Hamilton Lane, acquired Richardson Psychiatric Associates.

Valor Healthcare, a provider of federal healthcare services, acquired Mission Critical Psychological Services, which provides telehealth-based care for federal government agencies, government contractors, and first responders.

Valera Health expanded its presence in digital psychiatry with its acquisition of suicide prevention startup Vita Health. The move positions Valera to advance its value-based care contracting and other payment efforts, according to a media report.

Nashville, Tennessee-based Acute Behavioral Health, a provider of services for young people, completed an acquisition of Nova Behavioral Health’s Oakwood Treatment Center, a residential treatment facility for young people and their families in Kinston, North Carolina.

Other Q2 deals in the mental health subcategory included the following:

Teledoc increased its investment in virtual mental healthcare with its acquisition of UpLift in a $30 million, all-cash transaction.

Sword Health, a digital pain management startup, announced a $40 million funding round led by General Catalyst.

Digital mental health platform Kindbridge Behavioral Health announced that it has raised $5.4 million in a multi-year funding round that began in 2022.

Noma Therapy announced a $4.25 million funding round to support an expansion of its virtual psychiatry services, including ketamine-assisted therapy.

Autism and Intellectual/Developmental Disabilities M&A

While overall deal volume in the subcategory of intellectual/developmental disabilities (I/DD) and autism services dropped to seven transactions in Q2 from the 12 reported in the previous quarter, there was an increase in private equity-backed strategic deals.

Five PE-backed strategic deals were announced in the second quarter, including the following:

Shorehaven was acquired by Sevita, a Minnesota-based home- and community-based healthcare company previously known as The Mentor Network and Civitas Solutions Inc.

Alongside ABA, formerly known as Autism Spectrum Interventions, expanded its footprint in Southern California with its acquisition of San Diego Applied Behavioral Analysis.

Active Day expanded its presence in the I/DD services market with its acquisition of PremierCare Consulting, which is contracted with the Illinois Division of Developmental Disabilities to provide person-centered planning and case management.

Abound Health expanded its service offerings in North Carolina with an acquisition of Heartspring, a provider of mental health and I/DD services in the Charlotte area.

Among other deals reported in Q2, Behavior Frontiers, a national provider of autism therapy services, announced its sale to NexPhase Capital, a private equity firm with experience in autism therapy, healthcare and software development.

If you would like to download this report in a PDF file, click the link below.

Comments