Home-Based Care Public Company Roundup Q3 2025

- Emin Beganovic

- Nov 17

- 9 min read

Updated: Dec 9

Mertz Taggart follows the publicly traded home-based care companies and reports on their earnings calls each quarter. As a group, public company performance and share price serve as a proxy for industry performance and investor sentiment, respectively. Historically seen as the “ultimate consolidators”, the publicly traded home-based care trading multiples have a downstream effect on lower middle market home-based care M&A.

Addus Homecare (Nasdaq: ADUS)

Highlights

Addus posted revenue of $362.3 million for the quarter, up 25% from Q3 2024. Growth was led by the Personal Care segment, which represents 76% of the business and saw a 6.6% same-store revenue increase and a 28% overall revenue increase year-over-year, driven by strong hiring and patient volumes. The segment has also seen favorable reimbursement support in many states, including rate increases in Illinois and Texas, the company’s two largest markets.

The company’s Hospice segment, representing 19% of Q3 2025 revenue, increased same-store revenue by 19% over the prior year quarter, supported by a 9.5% and 6.5% increase in same-store average daily census and admissions, respectively. The Home Health segment, representing 5% of the business, saw a 2.8% decline in year-over-year same-store revenue, but remains a key clinical partner to the company’s other operating segments.

Adjusted EBITDA for the quarter came in at $45.1 million, a 31.6% increase over the prior year quarter, reflecting continued operational excellence and cost management.

Heather Dixon was elevated to President and COO, replacing Brad Bickham who has taken an advisory role in anticipation of his retirement in March 2026.

Key Financial Figures

M&A Activity

On October 1, Addus announced the acquisition of the personal care operations of Del Cielo Home Care Services, increasing the company’s presence in the South Texas personal care market.

CEO Dirk Allison commented, “Our team is excited about this acquisition, and I want to officially welcome the Del Cielo Home Care team to the Addus family. Going forward, our development team will continue to focus on both clinical and nonclinical acquisition opportunities to increase both the density and geographic coverage to our current states. While the proposed home health rule will most likely continue to delay any meaningful home health opportunities, we will be evaluating smaller clinical transactions along with personal care service transactions that fit our strategy.”

The company also completed the acquisition of Helping Hands Home Care Services, a personal care, home health and hospice provider serving the Western Pennsylvania market, on August 1.

Guidance

Management expects a gross margin benefit of 40 basis points year-over-year and 20 basis points sequentially from increased hospice reimbursement and lower unemployment taxes in Q4 2025.

Aveanna Healthcare (Nasdaq: AVAH)

Highlights

Aveanna reported Q3 2025 revenue of $621.9 million, an increase of 22.2% over the prior year quarter. Growth was largely driven by the Private Duty Services segment, which represents 83% of the business and grew 25.6% year-over-year, and the Home Health & Hospice segment, which is responsible for 10% of the company’s quarterly revenue and grew 15.3%.

The Private Duty Services unit’s growth was driven primarily by a 12.9% volume increase over the prior year quarter to approximately 11.8 million hours of care and a 12.7% increase in revenue per hour to $43.51 as a result of preferred payor volume growth and rate enhancements.

Adjusted EBITDA surged 67.5% year-over-year to $80.1 million due to growing volumes, an improved rate environment and the company’s cost savings initiatives.

Aveanna continues to pursue its preferred payor strategy in order to secure more value-based agreements and enhanced reimbursement rates, which has resulted in five additional preferred payor agreements this quarter and improved caregiver hiring and retention. Preferred payor agreements now account for approximately 56% of total Private Duty Services MCO volumes, inclusive of the company’s recent acquisition of Thrive Skilled Pediatric Care.

Key Financial Figures

M&A Activity

CEO Jeff Shaner highlighted the successes of the recent Thrive acquisition and said, “I’d expect us to do more Thrive-like acquisitions in 2026 to continue to build out more Medicaid states.” The company is still on track to complete the integration by the end of the year.

Management also shared continued improvements to the company’s liquidity position as a result of increased free cash flow generation and debt refinancing, which allows Aveanna to continue to pay down debt and execute on its M&A strategy.

Guidance

Management has once again raised its full-year 2025 outlook based on the strength of Q3 2025 and year-to-date results. Full-year 2025 revenue and adjusted EBITDA is expected to be above $2.375 billion and $300 million, respectively.

CEO Jeff Shaner reiterated the company’s commitment to their five primary strategic initiatives: enhancing partnerships with preferred and government payors, identifying cost efficiencies, modernizing the Medical Solutions unit, managing capital structure and cash collection and engaging leaders and employees in delivering the Aveanna mission.

The Pennant Group, Inc. (Nasdaq: PNTG)

Highlights

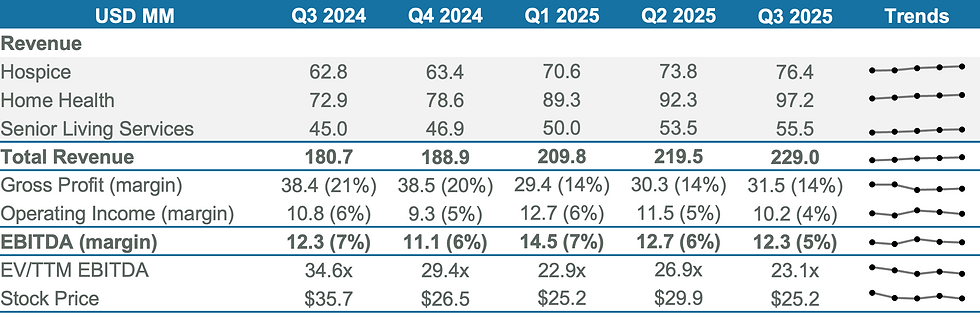

Pennant Group reported total revenues of $229 million for Q3 2025, a 26.8% or $48.4 million increase year-over-year, driven by growth across all three of its operating segments, including a 21.7% increase in Hospice revenue, a 33.3% increase in Home Health revenue, including other Home Care revenue, and a 23.2% increase in Senior Living revenue over the prior year quarter.

The Home Health segment, representing 42% of the business, saw increases of 36.2% in total admissions, 7% in same-store admissions and 2.9% in revenue per episode year-over-year.

The Hospice segment, representing 33% of Q3 revenue, also saw growth with average daily census, admissions, same-store average daily census and average revenue per day increasing 17.4%, 16.6%, 6.1% and 3.3% year-over-year, respectively.

The company amended its existing credit facility, adding a $100 million term loan to free up additional revolver capacity and provide dry powder to deploy strategically.

Key Financial Figures

M&A Activity

In September, Pennant Group closed the acquisition of Healing Hearts Home Health and Healing Hearts Outpatient Therapy, a single-site agency based in Gilette, Wyoming.

On October 1, the company closed its $146.5 million acquisition of 54 divested assets from

UnitedHealth Group and Amedisys, adding $189.3 million of combined trailing 12-month revenue of which 70% is related to Home Health while the remaining 30% is attributed to Hospice. The acquired assets are located in Tennessee, Georgia and Alabama, all of which are certificate of need states.

In November, Pennant Group acquired Twin Rivers Senior Living, a 55-bed assisted living community in Lewiston, Idaho, and the real estate of Honey Creek Heights Senior Living, a West Allis, Wisconsin-based assisted living community with 135 beds, after previously acquiring their operations at the start of the year. CEO Brent Guerisoli commented, “These acquisitions reflect our disciplined growth strategy and our dedication to delivering exceptional care.”

Management confirmed that the company will continue to evaluate M&A opportunities in spite of their heavy integration load, with CEO Brent Guerisoli noting, “Market forces and our own reputation as a quality buyer continue to drive a very robust pipeline of acquisition opportunities in all of our segments.”

Guidance

Management anticipates to close out 2025 with full-year revenue between $911.4 million and $948.6 million, while adjusted EBITDA is expected to land between $70.9 million to $73.8 million.

Enhabit Home Health & Hospice (Nasdaq: EHAB)

Highlights

Enhabit reported quarterly revenues of $263.6 million, a 3.9% increase from the prior year quarter. Growth was primarily driven by its Hospice segment, which grew 20% year-over-year.

Home Health revenue fell 0.2% from the prior year quarter but saw 4.3% admissions growth when normalizing for closed branches and a census increase of 3.7%.

Fee-for-service Medicare census has continued to stabilize, with the company reporting a 1.4% year-over-year decrease, which is a marked improvement from the 14.1% decline seen in Q3 2024. Non-Medicare admissions, in contrast, rose 10.4% year-over-year and non-Medicare revenue per visit grew 2.8% as a result of continued payor mix management.

The Hospice segment, representing 24% of Q3 revenue, has seen its seventh straight quarter of sequential census growth. Normalized for closed branches, admissions grew 3% over the prior year quarter while census grew 12.6%. The company has also added two de novo locations for a total of six newly opened locations year-to-date and are on pace for a total of 10 locations by year-end.

The company continues to focus on improving its financial health. Enhabit has been actively paying down debt with its free cash flow, reducing its leverage ratio to 3.9x from 5.4x in Q4 2023. This has lowered annual cash interest expense by approximately $19 million since Q4 2023.

Enhabit has grown its direct sales team by 21 or 11% year-over-year in order to unlock additional referral sources.

The company reduced its home office expenses by $2.3 million sequentially, landing at 9.1% of revenue compared to 9.9% of revenue in the prior quarter as part of its cost savings initiatives.

Key Financial Figures

M&A Activity

Management’s current focus is on deleveraging the balance sheet and have indicated that they will not be prioritizing M&A until they’ve succeeded in lowering their leverage ratio. As of quarter-end, the company has reduced its leverage ratio to 4.3x from 5.1x in Q2 2024.

Guidance

Management updated its 2025 full-year guidance, expecting revenue to land between $1.058 billion and $1.063 billion, and adjusted EBITDA is expected to be in the range of $106 million to $109 million.

Full-year 2025 adjusted free cash flow is expected to be between $53 million and $61 million.

Management reaffirmed its commitment to strategies designed to mitigate pricing headwinds next year as a result of the 2026 CMS Home Health proposed rule.

BrightSpring Health Services, Inc. (NASDAQ: BTSG)

Highlights

BrightSpring posted quarterly revenues of $3.3 billion, a 28% jump from the prior year quarter, and adjusted EBITDA of $160 million, representing a 31% year-over-year increase.

Growth was largely driven by the Pharmacy Solutions unit, which grew revenue 31% year-over-year and represents 89% of the business. The segment’s adjusted EBITDA surged 42% over the prior year quarter and saw a total pharmacy script volume of $10.8 million.

The Provider Services segment grew revenue and adjusted EBITDA by 9% and 16% year-over-year, respectively, driven by strong growth in the segment’s Home Health, Hospice and Primary Care businesses which collectively represent 50% of the segment’s revenue.

The company’s overall adjusted EBITDA margin grew 30 basis points both year-over-year and sequentially to 4.8%, driven by disciplined management of the company’s operating expenses and a greater contribution from generics in the Pharmacy Solutions unit.

Key Financial Figures

M&A Activity

The company pushed back the anticipated closing of its Community Living divesture to Q1 2026 from Q4 2025. BrightSpring expects to receive $715 million in net cash proceeds from the $835 million purchase price. The transaction remains subject to review by the Federal Trade Commission.

Management reaffirmed its expectation to close both the Amedisys and LHC branch acquisitions later this quarter and indicated that their financial impacts will be immaterial to their full-year 2025 results.

The company continues to focus its M&A efforts on tuck-in acquisitions, with CEO Jon Rousseau commenting, “Our M&A strategy will remain primarily focused on accretive tuck-ins in target geographies.” He indicated that BrightSpring will be targeting acquisitions in the $3 million to $10 million EBITDA range.

Guidance

Management revised their full-year 2025 guidance upwards as a result of their third quarter performance and higher expectations for Q4 2025. Adjusted EBITDA is expected to land between $605 million and $615 million, excluding any financial impact from the company’s soon-to-be divested Community Living segment.

Management continues to expect an additional 16 to 18 limited distribution drug launches over the next 12 to 18 months.

Option Care Health, Inc. (NASDAQ: OPCH)

Highlights

Option Care posted quarterly revenues of $1.5 billion, representing a 12.2% increase over the prior year quarter. Growth was underpinned by mid-teens and low double-digit growth year-over-year in their acute and chronic portfolios, respectively. The adoption of Stelara biosimilars, which carry a lower reference price and reimbursement rate, negatively impacted the company’s chronic portfolio growth by 380 basis points.

Gross profit grew 6.3% year-over-year to $272.9 million, but saw a margin decline due to the aforementioned adoption of Stelara biosimilars and the impact from lower margin orphan therapies.

Despite the margin pressure, Option Care reported adjusted EBITDA of $119.5 million, which represents a 3.4% increase over the prior year period as a result of strong revenue growth and disciplined cost management.

After refinancing and extending the maturity of their term loan to reduce borrowing costs and add an additional $50 million in liquidity, the company’s leverage ratio stands at 1.9x.

The company launched three new enhanced applications to drive efficiencies in the patient onboarding process and staffing utilization.

Meenal Sethna joined Option Care as the company’s CFO, filling in for Mike Shapiro who recently stepped down into a strategic advisory role.

Key Financial Figures

M&A Activity

Option Care continues its integration efforts from its acquisition of Intramed Plus, an infusion services provider serving South Carolina, earlier in the year.

Newly-appointed CFO Meenal Sethna reaffirmed management’s intentions to continue evaluating potential tuck-in acquisitions, saying, “We remain active in assessing M&A opportunities, focusing on strategic tuck-ins and near adjacency opportunities.”

Guidance

Management updated its guidance for full-year 2025 and expects to generate revenue of $5.6 billion to $5.65 billion and adjusted EBITDA of $468 million to $473 million.

Option Care reaffirmed its expectation to generate over $320 million in cash flow from operations.

The company, consistent with comments from prior earnings releases, does not expect potential tariffs, most favored nation pricing and other similar policy changes to have a material impact on full-year 2025 earnings.

To download the .pdf version of this report, click below.

Disclaimer

The information contained in this document is provided for informational and marketing purposes only by Mertz Taggart and is not intended as investment, financial, legal, tax, or other professional advice. The content has been compiled using publicly available sources, including but not limited to SEC filings accessed via EDGAR, Seeking Alpha, and Yahoo Finance. While we strive to ensure the accuracy and reliability of the information presented, Mertz Taggart does not warrant or guarantee the completeness, timeliness, or accuracy of the information, nor shall it be held liable for any errors or omissions.

This document does not constitute a solicitation, recommendation, or offer to buy or sell any securities or other financial instruments. Any views or opinions expressed are those of the author(s) and do not necessarily reflect the views of Mertz Taggart or its affiliates.

Recipients should not rely solely on the information herein for making investment or strategic decisions. All readers are encouraged to conduct their own independent research and to consult with their professional advisors before making any financial or business decisions.

All trademarks, logos, and brand names mentioned are the property of their respective owners and are used in this document for identification purposes only.

Comments