Home-Based Care Public Company Roundup Q2 2025

- Aug 18, 2025

- 10 min read

Updated: Aug 20, 2025

Mertz Taggart follows the publicly traded home-based care companies and reports on their earnings calls each quarter. As a group, public company performance and share price serve as a proxy for industry performance and investor sentiment, respectively. Historically seen as the “ultimate consolidators”, the publicly traded home-based care trading multiples have a downstream effect on lower middle market home-based care M&A.

Addus Homecare (Nasdaq: ADUS)

Highlights

Addus reported $349.4 million in revenue, up 21.8% from Q2 2024. Growth was led by the Personal Care segment, which represents 77% of the business and saw a 7.4% year-over-year organic revenue increase, driven by higher volumes, state rate hikes, especially in Illinois, and strong hiring.

The company’s EBITDA margin rose 24.3% year-over-year to $36.8 million, and net income increased by 34.1% year-over-year to $21.2 million, reflecting robust operational execution and profitability.

The company’s Hospice segment, representing 17.8% of Q2 2025 revenue, grew organically by 10%, supported by higher census and greater patient days and revenue per day metrics. The Home Health segment, representing 5.2% of the company’s quarterly revenue, remains a key clinical partner to the Personal Care and Hospice segments.

Net operating cash flow totaled $22.5 million for the quarter. The company reduced its bank debt by $30 million, bringing the balance to $173 million at quarter-end, and maintained a cash position of $97 million on its balance sheet.

The company averaged 105 hires per business day in Q2, supported by high adoption of its caregiver app in Illinois (90%) and expansion to New Mexico.

Key Financial Figures

M&A Activity

On August 1, 2025, Addus acquired Helping Hands Home Care Service for $21.3 million, funded through its revolving credit facility and cash on hand. The acquisition expands the company’s Personal Care segment’s density in Western Pennsylvania and adds additional Hospice and Home Health capabilities in the region.

"As we have with this most recent acquisition, our development team will continue to focus on both clinical and nonclinical acquisition opportunities that increase both the density and geographic coverage to our current states,” CEO Dirk Allison commented.

Guidance

Management anticipates upcoming reimbursement rate increases in Illinois and Texas to add $17.5 million and $17.7 million in annualized revenue, respectively, with low‑20% margins, effective September 1, 2025 (Texas) and January 1, 2026 (Illinois), pending federal approval.

Adjusted EBITDA margin for the full-year 2025 period is expected to remain between 12% and 13%.

Gross margin in Q4 2025 is expected to expand slightly due to rate increases in the Hospice segment and a reduction in payroll tax liabilities.

Aveanna Healthcare (Nasdaq: AVAH)

Highlights

Aveanna reported Q2 2025 revenue of $589.6 million, up 16.8% year-over-year, driven by 19.2% growth in the Private Duty Services segment, 10.0% in Home Health & Hospice, and 2.2% in Medical Solutions. The Private Duty Services segment’s growth was driven by 11.1 million hours of care, a volume increase of 6.9% from Q2 2024.

Reported EBITDA surged 115.3% from Q2 2024 due to an improved rate environment, increased patient volumes, and enhanced operational efficiencies. Additionally, Q2 2025 results were positively impacted by several timing-related revenue items such as annual value-based payments in the Private Duty Services segment which contributed $9 million to revenue and EBITDA.

The Private Duty Services segment, which represents 82.4% of Q2 2025 revenue, saw 10 rate enhancements year-to-date and added one additional preferred payer agreement in the current quarter to bring the total to 25 preferred payer agreements, which has allowed the company to invest in caregiver wages and recruitment efforts. Preferred payer agreements accounted for 55% of Aveanna’s total Private Duty Services MCO volumes in the quarter.

Key Financial Figures

M&A Activity

Aveanna closed its acquisition of Thrive Skilled Pediatric Care and is expecting to finalize the integration in the coming months, allowing the company to refocus on additional M&A opportunities in both the latter half of this year and the beginning of next year.

CFO Matt Buckhalter highlighted enhancements to the company’s liquidity position through an extension of its securitization facility to 2028 and more favorable pricing to provide “flexibility to operate the business and invest in continued growth and future M&A.”

CEO Jeff Shaner also shared an intention to lean into M&A as a growth lever in both the Private Duty Services and Home Health & Hospice segments, as well as exploring tuck-in opportunities in its Medical Solutions segment beginning in 2026.

Guidance

Management raised its outlook for full-year 2025 based on the strength of their Q2 2025 and year-to-date results, which includes a 2025 revenue and adjusted EBITDA target of greater than $2.3 billion and $270 million, respectively, inclusive of the Thrive acquisition.

CEO Jeff Shaner reiterated a commitment to enhancing partnerships with government partners and preferred payers, identifying cost efficiencies and synergies to continue growth, and modernizing the Medical Solutions segment to achieve their target operating model.

The Pennant Group, Inc. (Nasdaq: PNTG)

Highlights

Pennant Group reported total revenue of $219.5 million for Q2 2025, a 30.1% or $50.8 million increase year-over-year, driven by increases across all segments including a 24.3% increase in Hospice revenue, a 39.8% increase in Home Health revenue, including other Home Care revenue, and a 23.1% increase in Senior Living revenue over the prior year quarter.

The Home Health segment, representing 42.0% of the business, grew admissions by 26.1%, including a 21.6% increase in Medicare admissions, since Q2 2024. Despite the CMS proposed rule cut for Home Health reimbursement, management expects little disruption given Medicare only represents 18% of their total Home Health revenue in Q2 2025.

The Hospice segment, representing 33.6% of Q2 2025 revenue, saw 14.7% growth in admits along with a 21.4% and 3.3% increase in average daily census and revenue per day, respectively, over the prior year quarter.

Key Financial Figures

M&A Activity

Pennant Group announced their purchase of divested assets from UnitedHealth Group and Amedisys as a result of their antitrust settlement with the Department of Justice. Management expects the assets to include close to 50 locations in Tennessee, Georgia, and Alabama at a purchase price between $113 million and $147 million, implying an EBITDA multiple in the 4x to 8x range.

Management announced their acquisition of GrandCare Home Health on July 1, 2025, which provides Home Health services in Los Angeles, Orange, and Riverside counties in California. President and COO John Gochnour commented, "The acquisition expands Pennant's service area in a region where we have a number of senior living communities creating a unique opportunity to build a Pennant care continuum.“

Management also reiterated its commitment to growth by M&A despite recent regulatory headwinds in the Home Health space. COO John Gochnour confirmed, "The pipeline is robust. There's a lot of opportunities right now."

Guidance

Management raised its outlook for full-year 2025 based on positive momentum from expanded operations and upside in their existing operations. Full-year revenue is anticipated to be between $852.8 million and $887.6 million, while full-year adjusted EBITDA is expected to land between $69.1 million and $72.7 million.

Enhabit Home Health & Hospice (Nasdaq: EHAB)

Highlights

Enhabit reported Q2 2025 consolidated net revenue of $266.1 million, up 2.1% year-over-year and 2.4% sequentially. Sequential growth was driven by an increase in average daily census across both its Home Health and Hospice segments, while year-over-year growth was buoyed by the Hospice segment’s strong performance.

Home Health revenue fell 2.0% from Q2 2024 due to declining Medicare patient volumes, but the rate of decline has been steadily improving from management’s efforts to maintain a healthy payer mix. Q2 2025 admissions grew 1.3% year-over-year, or 2% when adjusting for closed branches.

The Hospice segment continues its strong growth trajectory, with the company posting its sixth straight quarter of sequential census growth. Hospice revenue grew 19.4% over the prior year quarter, and management intends to continue their de novo strategy to further boost volume, with a target of ten new locations by the end of 2025.

Enhabit reduced its bank debt by $10.5 million, including amortization and prepayments, and ended the quarter with a cash position of $37 million.

The company is continuing with its cost savings initiatives and have successfully delivered a 6% year-over-year improvement in general and administrative expenses. By the end of Q2 2025, Enhabit has either closed or consolidated 11 branches and have indicated that an additional Home Health and Hospice branch will be consolidated by the end of Q3 2025.

CEO Barbara Jacobsmeyer announced that she would be stepping down from her role as CEO, President, and member of the board of directors in July 2026 or upon the appointment of a successor.

Key Financial Figures

M&A Activity

Management’s current focus is on deleveraging the balance sheet and have indicated that they will not be prioritizing M&A until they’ve succeeded in lowering their leverage ratio. As of quarter-end, the company has reduced its leverage ratio to 4.3x from 5.1x in Q2 2024.

Guidance

Management has updated its outlook for full-year 2025 which includes a revenue target between $1.06 billion and $1.07 billion, as well as an adjusted EBITDA target between $104 million and $108 million.

Full-year 2025 free cash flow is expected to be in the range of $47 million to $57 million.

Management reaffirmed their intention to optimize visits per episode to meaningfully offset reimbursement headwinds as a result of the 2026 CMS Home Health proposed rule.

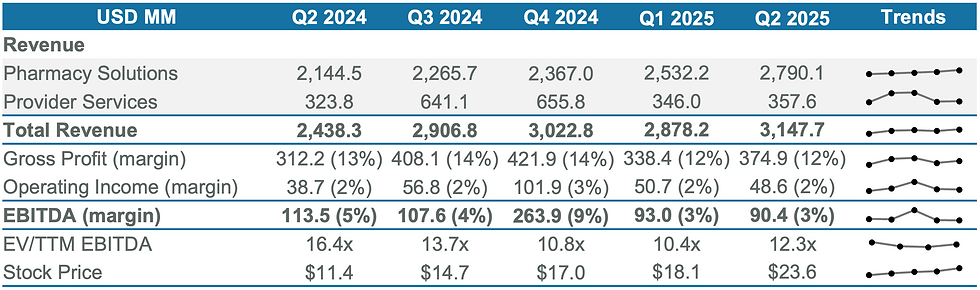

BrightSpring Health Services, Inc. (NASDAQ: BTSG)

Highlights

BrightSpring posted a total company revenue of $3.1 billion, representing 29% growth year-over-year, and adjusted EBITDA growth, excluding its soon-to-divested Community Living division, of 29% year-over-year, driven by strong volume growth, particularly in the Onco360 and CareMed Specialty Pharmacy businesses.

The Pharmacy Solutions segment saw strong growth of 32% year-over-year driven by a 38% year-over-year increase in specialty scripts and five limited distribution drug launches within the quarter. BrightSpring was also selected as the national pharmacy partner for multiple novel therapies targeting advanced cancers and rare genetic disorders.

The Provider Services segment grew 11% from the prior year quarter, led by 17% year-over-year growth in its Home Health, Hospice, and Primary Care businesses, 9% year-over-year growth in its Rehab Care business, and 4% year-over-year growth in its Personal Care business.

Key Financial Figures

M&A Activity

The company expects to close its Community Living divesture in Q4 2025, subject to review by the Federal Trade Commission, and receive $715 million of net cash proceeds from the $835 million purchase price.

CEO Jon Rousseau reaffirmed the company’s baseline inorganic growth strategy of closing 8 to 10 tuck-in acquisitions annually while they continue to wait for further news on the UnitedHealth Group and Amedisys divestiture.

Guidance

Management has provided an updated outlook for full-year 2025 results including an increased total revenue range of $12.2 billion to $12.6 billion, which includes Pharmacy Solutions revenue of $10.75 billion to $11.1 billion and Provider Services revenue of $1.45 billion to $1.5 billion. The updated total revenue range reflects a 21.1% to 25.1% increase over full-year 2024 when excluding the Community Living business in both years.

CFO Jen Phipps commented, “Our increased total revenue guidance is primarily driven by an improved pharmacy revenue outlook, including growth in LDDs and generic drug conversion and utilization opportunities and consistent growth on the provider side.”

Management also increased its adjusted EBITDA target by $20 million in each of the low and high ends of their previously communicated range to $590 million to $605 million, primarily driven by strong pharmacy growth, procurement and efficiency initiatives across both the Pharmacy Solutions and

Provider Services segments, strong provider performance, and improved profitability in infusion care.

Option Care Health, Inc. (NASDAQ: OPCH)

Highlights

Option Care reported $1.4 billion in Q2 2025 revenue, which represents a 15% increase over the prior year quarter, underpinned by mid-teens growth in both their acute and chronic portfolios of therapy.

The company highlighted that their growth in acute therapy was notably higher than the growth rate of the overall market, emphasizing strong execution in adapting to shifting industry dynamics.

Gross profit grew 8% year-over-year to $269 million, but the margin rate was negatively impacted by some lower-margin services including limited distribution drugs and rare and orphan therapies, however, management are encouraged by these services’ contributions to their gross profit on an absolute dollar basis.

Option Care generated over $90 million in net operating cash flow in Q2 2025 and expects to generate over $320 million in net operating cash flow in the full-year 2025 period.

Key Financial Figures

M&A Activity

Management continued to emphasize thoughtful M&A activity as a key lever for growth. CEO John Rademacher commented, “Our commitment to shareholders has always been that it will be both strategic and economic when we're evaluating where we deploy your capital in those type of activities. And therefore, I think you'll see us in a very disciplined way, continue to look for opportunities to utilize the strength of the balance sheet in ways that will enhance value for our shareholders.”

The company also reiterated its commitment to M&A in its SEC filings writing, “Our business strategy includes the deployment of capital to pursue acquisitions that complement our existing operations. We continue to evaluate acquisition opportunities and view acquisitions as a key part of our growth strategy.”

Guidance

Option Care raised its full-year 2025 outlook as a result of strong Q2 2025 results and balanced growth across its entire portfolio.

The company raised its revenue guidance to $5.5 billion to $5.65 billion and its adjusted EBITDA guidance to $465 million to $475 million.

Management expects their new revenue and adjusted EBITDA targets to result in an adjusted earnings per share between $1.65 and $1.72.

The company does not expect a material financial impact in full-year 2025 from potential tariffs, MFN pricing, and similar policy changes.

To download the .pdf version of this report, click below.

Disclaimer

The information contained in this document is provided for informational and marketing purposes only by Mertz Taggart and is not intended as investment, financial, legal, tax, or other professional advice. The content has been compiled using publicly available sources, including but not limited to SEC filings accessed via EDGAR, Seeking Alpha, and Yahoo Finance. While we strive to ensure the accuracy and reliability of the information presented, Mertz Taggart does not warrant or guarantee the completeness, timeliness, or accuracy of the information, nor shall it be held liable for any errors or omissions.

This document does not constitute a solicitation, recommendation, or offer to buy or sell any securities or other financial instruments. Any views or opinions expressed are those of the author(s) and do not necessarily reflect the views of Mertz Taggart or its affiliates.

Recipients should not rely solely on the information herein for making investment or strategic decisions. All readers are encouraged to conduct their own independent research and to consult with their professional advisors before making any financial or business decisions.

All trademarks, logos, and brand names mentioned are the property of their respective owners and are used in this document for identification purposes only.

Too busy to complete your assignments? You can pay someone to do my homework, getting expert assistance, timely submissions, and quality results while saving time and reducing academic stress for better performance.

Had to write my essay online last minute and stumbled upon PayForEssay. The result was so much better than I expected. The writer clearly understood the topic and followed all my notes. The delivery was fast, and there were no grammar issues whatsoever. For anyone juggling work and school, this is a great option that won’t break your budget.

Looking for top-quality PowerPoint presentation services near you? Our expert team specializes in crafting visually stunning, professional slides tailored to your specific needs—whether it’s for business meetings, academic projects, or corporate events. We focus on clear messaging, engaging design, and impactful visuals that capture your audience’s attention and leave a lasting impression. From custom templates and branded graphics to data visualization and animation, we handle every detail to make your presentation stand out. Get a polished, ready-to-present deck that saves you time and elevates your ideas, all conveniently available right in your area.

I have been observing Addus and similar firms to find binding services near me that will help to take care of my aging parents. It is nice to see the growth, especially on the personal care and hospice side. I find their emphasis on hiring and adoption of technology in states like Illinois to be really significant. It would be interesting to see how the steady growth, such as this, would add pressure to the availability of local care options. Home-based services may hopefully be made available in smaller communities, too.

This comprehensive roundup of Q2 2025 performance highlights the resilience and growth potential of home-based care companies. The detailed financials and strategic M&A activities underscore the importance of a solid business plan in navigating this dynamic industry. For those seeking assistance, a real estate business plan writing service can provide valuable support in crafting effective strategies for growth and investment.